tax identity theft definition

Losing personal identification is a very serious problemIf youve lost your drivers license or Social Security card immediately file a police report to prevent it from being misusedNext file a report at the Department of Motor Vehicles DMV. In the typical refund theft situation an identity thief uses a taxpayers SSN to file a false tax return and claim the refund associated with it.

What Is Identity Theft Definition From Searchsecurity

The identity thief may use your information to apply for credit file taxes or get medical services.

. Since 2015 the Department has stopped over 108 million in fraudulent tax refunds. To obtain credit cards from banks and retailers. Unlike some other forms of identity theft it can be hard to take preventative measures to avoid tax identity theft.

More from HR Block. The illegal use of someone elses personal information such as a Social Security number especially in order to obtain money or credit. This happens if someone uses your Social Security number for employment or they used the information from your W-2 to file income tax returns on your behalf and take your tax refund.

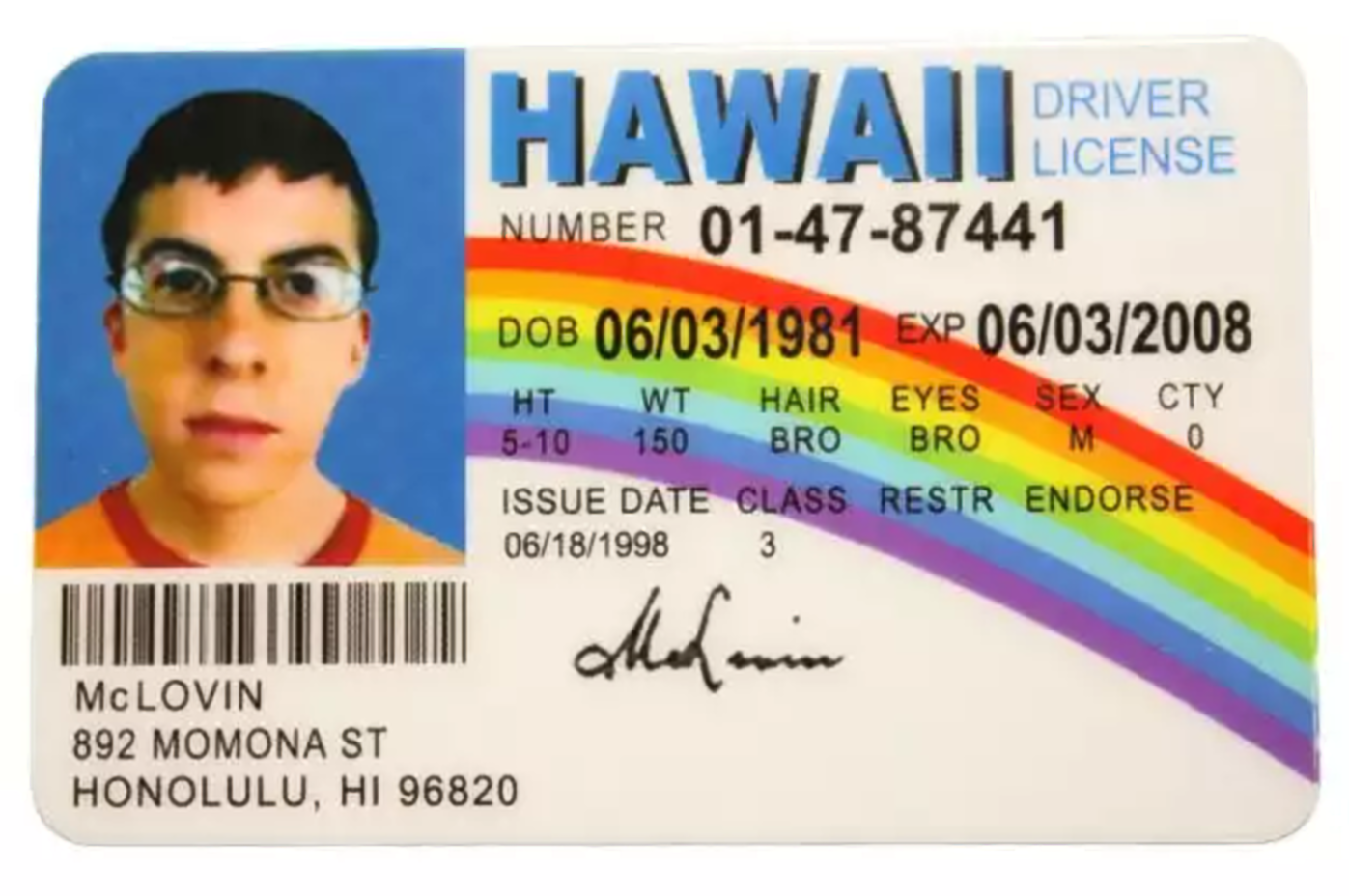

Identity thieves target information like names dates of birth drivers licenses social security cards insurance cards credit cards and bank information. The bureau you contact must tell the other two. Financial identity theft seeks economic benefits by using a stolen identity.

This is done so that the thief can claim the victims tax return for themselves. The Department of Revenue is committed to taxpayer security and preventing refund fraud. People often discover tax identity theft when they file their tax returns.

Sign Up for a 30-day Trial Today. Open All Warning Signs of ID Theft. Place a free one-year fraud alert on your credit reports by contacting any one of the three nationwide credit reporting companies online or through their toll-free numbers.

To apply for loans. Or to establish accounts using anothers name. The most common method is to use a persons authentic name address and Social Security Number to file a tax return with false information and have the resulting refund direct-deposited into a bank account controlled by the thief.

Ad We Look for Threats to Your Identity and Can Help Reimburse Stolen Funds. Often the identity thief claims the refund long before the taxpayer even files his or her tax return leaving the taxpayer blindsided when the thief has claimed the refund and moved on. Identity theft is the illegal use of someones personal information for individual gain.

What is tax identity theft. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return.

Tax identity theft is when a criminal steals your information specifically your Social Security number and uses it to file a fraudulent tax return. Basically its identity theft plus tax fraud. Tax identity theft is a growing issue and occurs when someone uses another individuals Social Security number SSN to file a false tax return claiming a fraudulent refund.

If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you must file a paper return. In this type of exploit the criminal files a false tax return with the Internal Revenue Service IRS for example using a stolen Social Security number. Definition of identity theft.

Tax identity theft definition. To steal money from existing accounts. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund.

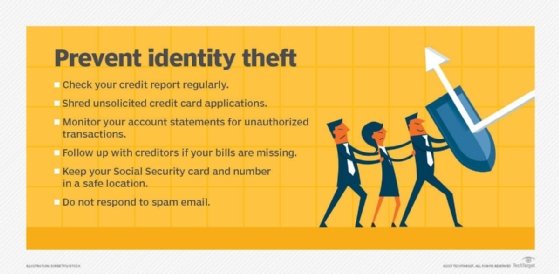

An identity thief can steal thousands of. How To Protect Yourself from Tax Identity Theft Taking steps to protect your personal information can help you avoid tax identity theft. Identity ID theft happens when someone steals your personal information to commit fraud.

Also known as identity fraud this type of theft can cost a victim time and money. Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. The fraudulent refund can be.

Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that youre entitled to one. To rent apartments or storage units. Tax identity thieves steal taxpayers names and Taxpayer Identification Numbers like Social Security Numbers or Individual Taxpayer Identification Numbers for one of two reasons.

Tax identity theft whether its with the Internal Revenue Service or your states Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolveThe IRS in partnership with the state tax administrations and the software companies that produce at-home filing software has announced several changes. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. Identity Theft is the assumption of a persons identity in order for instance to obtain credit.

ID theft through a tax professional. Tax identity theft whether its with the Internal Revenue Service or your. These acts can damage your credit status and cost you time and money to restore your good name.

Tax identity theft occurs when someone uses your personal information including your Social Security number to file a bogus state or federal tax return in your name and collect a refund. Identity theft occurs when someone fraudulently obtains or uses your personal information such as your name social security number or credit card number. This legislation created a new offense of identity theft which prohibits knowingly transfer ring or us ing without lawful authority a means of identification of another person with the intent to commit or to aid or abet any unlawful activity that constitutes a violation of federal law or that constitutes a felony under any applicable.

In many cases the taxpayer may not discover the fraud until attempting to file their taxes only to find that someone else has already fraudulently filed for them and cashed their refund check. Tax identity theft One of the major identity theft categories is tax identity theft.

Tax Identity Theft American Family Insurance

27 086 Identity Theft Stock Photos Pictures Royalty Free Images Istock

Tax Identity Theft American Family Insurance

Types Of Identity Theft Complete Id

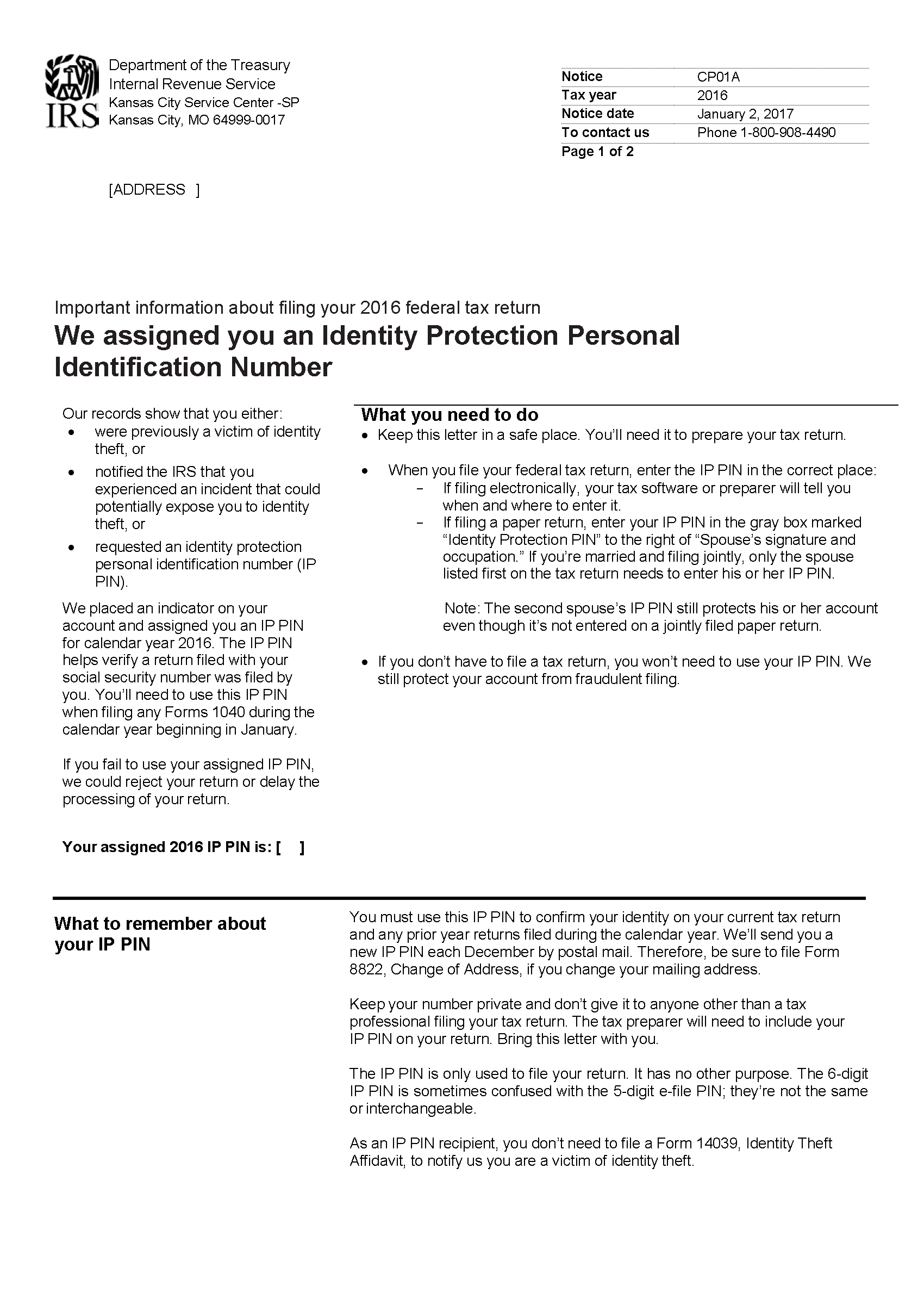

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

![]()

Business Identity Theft National Cybersecurity Society

What Is Tax Identity Theft And How Do You Prevent It Debt Com

Identity Theft Examples In Real Life Fully Verified

What Is Tax Identity Theft And How Do You Prevent It Debt Com

Learn About Identity Theft Chegg Com

Types Of Identity Theft And Fraud Experian

Identity Theft Definition What Is Identity Theft Avg

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

Identify Yourself Or Not Use Alternative Forms Of Verification

Identity Theft Vs Account Takeover What S The Difference Cyberdb

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)